House Prices Skyrocket in the North East

Written by Jack Nevin on 10th July 2025

An unlikely region tops the table as the average price of a house in England continues to rise exponentially.

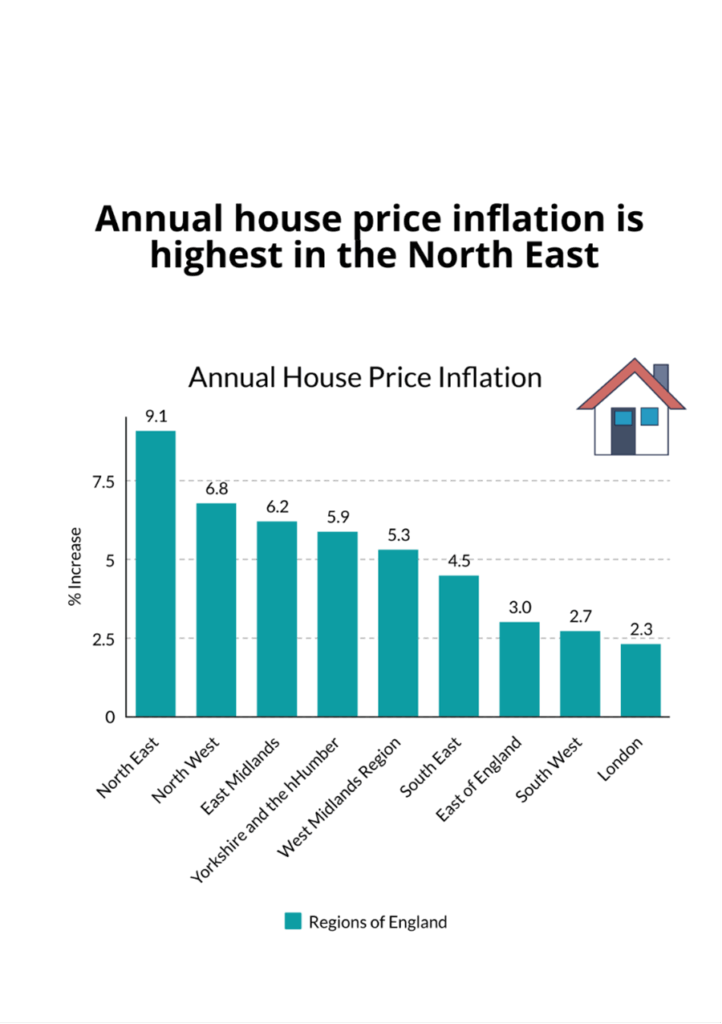

House prices in the North East are surging faster than anywhere else in England, according to new figures released by the Office for National Statistics.

The average house price for England rose by 4.8% in January 2025, an increase of £13,000 from the previous year.

However, the report from the ONS reveals that house prices in the North East have soared to almost double the national average, increasing from 6.9% to 9.1%.

There is a growing disparity in the price of houses between local authorities in the North East. County Durham and Sunderland have been revealed to have the lowest inflation rates, with a median house price to work place earnings of 4.8 and 4.6 respectively.

This differs to the more affluent areas of the region, which are experiencing an even greater surge in inflation, with Newcastle Upon-Tyne and Northumberland having a median house price to work place earnings of 5.7 and 6.2 respectively.

This means that the house price inflation is concentrated in certain regions of the North East, and that some areas in the region are less affordable to live than others.

The sharp rise in inflation is being attributed to the upcoming changes in stamp duty payments that are to take effect in April.

New legislation has resulted in buyers being required to pay stamp duty on properties priced at £300,000, a decrease from the previous threshold of 425,000.

A report by the Royal Institution of Chartered Surveyors concluded that buyers in the North East are scrambling to purchase properties before the stamp duty changes are implemented at the beginning of April, which has consequently inflated the average house price in the region due to the competitiveness of the market.

Kate Brewin, a prospective home owner from Newcastle, noted how the changes to the stamp duty payments and its subsequent impact on the housing market has set her and her partner even further back in their quest for a new home:

“Not only will we now have to save up even more money between us to reach the 10% deposit we will need as house prices are increasing, we will also probably have to pay stamp duty as the threshold has dropped. If we are struggling to place a deposit, how on earth will we afford the additional stamp duty payments?”

Yet despite having the steepest rise in house prices, the North East still remains one of the most affordable regions in England to purchase a property.

Data shows that the average house price in the North East is five times higher than the median annual salary in the region.

This remains well below the national average, where house prices in England typically cost seven times the median national living wage, making the North East stand out as one of the most affordable regions in the country despite recent surges in inflation.

The key task facing the government is curbing inflation so that regions like the North East, where housing is still relatively affordable, are not out-pricing local people from purchasing a property.

Sam Rushworth, MP for Bishop Auckland, emphasised how it is integral for houses to be built in the North East that are both affordable and contribute in creating vibrant and sustainable communities:

“Ensuring access to affordable housing is a top priority for me and for the government and we recognise the seriousness of the challenge.”

“We are committed to building 1.5 million new homes during this Parliament, with a strong emphasis on affordability.”

The constituency of Bishop Auckland is to benefit from over 100 new houses as part of a wider national strategy that plans to utilise £2 billion in government funding to build up to 18,000 houses across England.

Furthermore, the government has introduced measures to help first-time buyers get on the property ladder.

The ‘First Homes’ scheme allows eligible buyers the opportunity to purchase a house at a discount of at least 30% below the properties market value.

The discount scheme coincides with a new permanent mortgage guarantee scheme, which purports to help people struggling to save up for a deposit by making 95% of mortgages more widely available.

However, self-employed builder, Neil Tarver, has warned that the government’s plan to build more homes will fail to negate the surge in house price inflation:

“Legislation is slowing the building process down significantly, and with issues surrounding planning permission and environmental problems such as phosphates, we are constantly behind on house production.”

“This means that we are unable to build the number of homes to match the rise in population, and therefore houses on the market are surging in price due to the level of demand.”

Thus, critics argue that if the government is serious in tackling house price inflation, and ensuring that regions like the North East remain relatively affordable amidst the rise in prices, injecting billions of pounds into housing development will not curb the affordability crisis.

Rather, one way that the government could ensure that housing remains affordable is by scrapping legislation that prevents houses from being built quickly and efficiently, with a growing number of calls for the land value capture (LVC) system to be reformed.

This would allow the government to purchase land at a cheaper rate, consequently reducing the cost of properties built on that land.

However, in a region where it is still considered relatively affordable to live, a 9.1% price surge is a reminder that the government face a crisis in dealing with house price inflation, and that the affordability gap in the North East is rapidly narrowing.